How to Change Address of the Registered Office of a Company?

- September 25, 2021

- Change in Business

The registered office of a company is computed as a place where all the official connections concerning the company are sent. Other than the registered office, a company owns many various offices such as administrative office, branch office, corporate office, and factory. At the same time, it is essential for the registered office to register itself with the MCA (Ministry of Corporate Affairs). The company's operator decides the place and location of the registered office. Once the registered office of the company is announced through filing INC 22, any alterations in the registered office of the company are announced to the ROC (Registrar of Companies).

The registered office of the company determines the company's domicile. ROC is determined by the location of the registered office. Any alteration concerning the address of the registered office should be informed to the ROC (Registrar of Company) within 15 days.

| Table of Content: |

Reason for Change in Registered Office Address

Stakeholders and the board of directors’ residential area often decide the location of the registered office. The only reason considered is their comfort. Although, in some cases need arises to change the registered office location from one place to another.

- Company is required to change their registered office address when it is growing at a faster pace and the office space and infrastructure does not fit in as per the company’s current position.

- If you are in the last period of your company’s lease and you are thinking of hiring another office space at lease.

- If company is planning to explore new genres for business growth and hence planning to shift their registered office to a place where they can explore better market opportunities.

- If another company is investing in your company you registered office address will bound to shift.

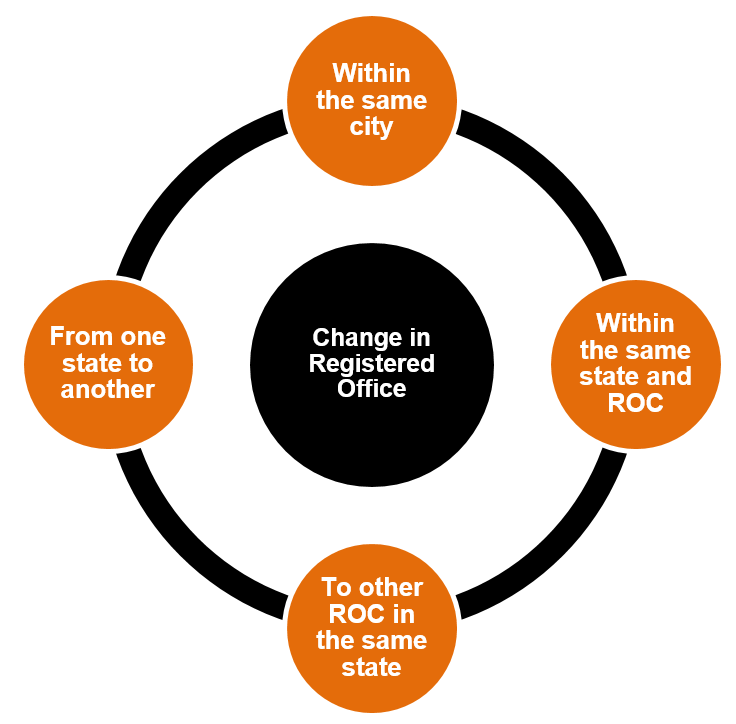

Types of changes in a Registered Office

A Company would want to change its office after some time. The registered office of a company needs to be changed with prior intimation. MCA has provided procedures to change the address of the company, this must be followed by the company. Types of changes in the address of the registered office are as follows:

- Within the same city

- Within the same state and ROC

- To other ROC in the same state

- From one state to another

We will have a detailed look here:

- Change in registered office address within the local limits of the city, town or village

- A Board meeting is conducted and a decision is made on the same

- An applicant is required to file Form INC-22 with the ROC and that’s too within 15 days from the date of passing the resolution.

- Change in the registered office of the company outside the local limits of the city, town or village- but within the same RoC and the same state

- A board meeting is managed in which the day, time, date and the venue of the Extra Ordinary General Meeting is fixed;

- A decision concerning the change in the registered office of the company’s address is passed in the Extra Ordinary General Meeting;

- With the ROC Form, MGT-14 is filed within thirty days from the date of passing the resolution.

- Change in registered office address from one RoC to another within the same state:

When the company wants to change the registered office from the jurisdiction to one ROC to the other ROC then first it is mandatory to apply for the approval of the Regional Director in the manner prescribed in form INC-23. If the regional director confirms the same, the company has to file the same confirmation the ROC within 60 days. The ROC must confirm the change of the address within 30 days of the filing.

- Change of address from one state to another, outside the existing RoC jurisdiction:

The procedure to shift the registered from one state to another is a bit different from others. The MOA of the company changes as the registered office address also changes.- It is necessary to hold a board meeting and pass a resolution to call an extraordinary general meeting.

- A special resolution is to be passed in the EGM about the change in the address of the registered office as well as for altering the MOA. The resolution must be filed in MGT14 within 30 days with the MCA.

- The company has to publish an advertisement for shifting the office not more than 30 days before the date of application to the regional director. It should be published in at least vernacular or the regional newspaper and in an English newspaper.

- The company should also send a notice to the creditors and the debenture holders if there are any and to other regulatory bodies as applicable to the company.

- An application to the Regional Director should be filed for shifting the registered office along with the documents that are specified.

- In case an objection is received then there is a hearing with the Central government and necessary orders will be passed. If no objection is received, then the order will be passed without any hearing.

- The confirmation received from the RD to the ROCs is to be filed by the company within 30 days from the date of the order.

- Within 30 days it is necessary to file form INC-22 to the ROC with the required documents.

The central government should dispose of the change of the registered office application outside the state within 60 days of the application and before passing the resolution it should confirm that the change is with the consent of the creditors, debenture holder, etc. The approval by the central government shall be filed with the registrars of both states. The ROC of the state wherein the new office will be located has to register the same and a new certificate of incorporation should be issued.

Important and Common Documents Requirement for Change in Registered Office

- New Address of Company for The Registered Address

- Title document, If the new address is owned by the company, or

- Rent Agreement + Rent Receipt, of the new address, or

- Utility Bill of Premises & NOC From Owner of the new address

- Copy of the Board Resolutions for filing with ROC

- Certification by professionals (CA/CS/CMA)

- Filing of Form INC-22 with MCA Govt Fee

Compliances after ROC Approval for Change in Registered Office

The compliances that a company needs to follow after changing its registered office upon receipt of approval of ROC are as follows:

- The company can issue a general notice by way of an advertisement in a newspaper informing all the members and stakeholders about the change of the company’s registered office.

- Printing of new MOA and changing the address of the company’s registered office outside of every office, building, etc., where it carried on the business, in legible letters and conspicuous position.

- Substitute the old address printed on all business letter-heads, letters, invoices, billheads, receipt forms and other official publications with the new address.

- Update the new registered office address with all the banks and financial institutions where the company is having bank accounts.

- File application with the Income Tax Authority for updating the company address in TAN and PAN.

- Update the company’s new address with its utility service providers like telephone and internet connections, electricity providers, etc., in the company name.

- Update the company’s new address with government authorities like Customs Authorities, Central Excise Authorities, Service tax Department, and Sales Tax Authorities.

Takeaway

Changing the Registered Office online India is not changing your primary address or location of the company. Generally, a company owns various different locations as their office premises like administrative office, branch office, corporate office, factory and warehouse but a registered office is the starting place for all types of business. Once a registered office is filled while filling INC 22, then for any changes in the registered office of the company, a process of Change in Registered office has to be intimated to the ROC.

We hope this article was of some help to clear of your queries relating to change in the registered office. For any further queries and issues you can drop us an email at [email protected]. Our team of experts are always ready to provide you the best possible solutions for your business.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.